Finding the right Car Insurance can feel like navigating a maze. Renewal reminders, confusing policy names, and dozens of options popping up online… it’s easy to get overwhelmed.

But here’s the good news: you don’t have to stress. Whether you’re renewing your existing policy or thinking of switching to a better plan, this guide breaks down the top 10 car insurance plans in 2025 their prices, coverage, benefits, and what makes them stand out. No jargon, no fluff—just what you need to know to make an informed decision.

Why Choosing the Right Car Insurance Matters

You might think, “Insurance is just insurance, right? I’ll pick the cheapest one.”

Not exactly. Your car insurance is your safety net. It protects you from accidents, theft, natural disasters, and even third-party damages. The right plan can save you thousands in emergencies, while the wrong one might leave you under-covered.

That’s why comparing plans based on price, coverage, benefits, and customer service is crucial. And yes, it doesn’t have to be complicated.

Top 10 Car Insurance Plans for 2025

Here’s a quick look at the best car insurance plans globally this year, considering coverage, benefits, pricing, and customer satisfaction.

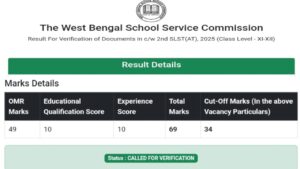

| Insurance Provider | Starting Price (Annual) | Coverage Limits | Key Benefits | Customer Rating (out of 5) | |

|---|---|---|---|---|---|

| 1 | GEICO (USA) | $500 | Up to $1M liability | 24/7 claims, roadside assistance, easy online tools | 4.7 |

| 2 | Progressive (USA) | $550 | Up to $1M liability | Snapshot discounts, multi-policy savings, accident forgiveness | 4.5 |

| 3 | State Farm (USA) | $600 | Up to $1M liability | Large agent network, flexible coverage, teen driver options | 4.6 |

| 4 | Allianz (Global) | $450 | Up to $2M liability | International coverage, comprehensive plans, travel protection | 4.5 |

| 5 | AXA (Global) | $470 | Up to $1.5M liability | Roadside assistance, global support, no-claims bonus | 4.4 |

| 6 | Bajaj Allianz (India) | $300 | Up to $500k third-party + own damage | Cashless claims, 24/7 support, add-on covers | 4.3 |

| 7 | HDFC Ergo (India) | $320 | Up to $500k third-party + own damage | Zero depreciation, engine protection, roadside assistance | 4.4 |

| 8 | ICICI Lombard (India) | $310 | Up to $500k third-party + own damage | Quick claims, flexible add-ons, long-term policies | 4.2 |

| 9 | Direct Line (UK) | $400 | Up to £1M liability | Accident forgiveness, courtesy car, breakdown cover | 4.3 |

| 10 | Aviva (UK) | $420 | Up to £1M liability | Comprehensive coverage, legal assistance, multi-car discounts | 4.2 |

Prices are approximate annual premiums for standard coverage; actual rates may vary by country, car type, and driver profile.

How to Choose the Right Plan for Renewal or Switching

Choosing or switching car insurance isn’t just about picking the cheapest option. Here’s a simple approach:

1. Check Your Current Coverage

- Look at your existing policy’s coverage limits, deductibles, and add-ons.

- Ask yourself: “Do I need more protection this year? Less?”

2. Compare Plans Side by Side

- Use comparison tables like the one above.

- Consider price vs coverage—sometimes a slightly higher premium gives you significantly better protection.

3. Look for Discounts & Add-Ons

- Multi-policy discounts (home + car)

- No-claims bonus

- Roadside assistance

- Zero depreciation cover

4. Check Customer Support & Claims Process

- Read reviews about claim settlement speed and customer service.

- A smooth claims process can save tons of stress during accidents.

5. Consider Your Driving Profile

- If you drive frequently, comprehensive coverage might be better.

- For city drivers with low mileage, liability coverage might suffice.

Benefits of the Top 10 Plans

- Peace of Mind: You know you’re protected against major financial losses.

- Extra Perks: Many top providers offer roadside assistance, rental car support, or accident forgiveness.

- Flexible Policies: Add-ons let you tailor coverage without paying for unnecessary extras.

- Global Support: If you travel internationally, some providers like Allianz or AXA give worldwide coverage.

Renewal vs Switching: Which Should You Do?

- Renewal: If your current policy is satisfactory, has good claims service, and offers competitive rates, renewing is easier.

- Switching: Consider switching if:

- Your premiums are rising too fast

- You want better coverage or add-ons

- You’re unhappy with claims service

- You found a better deal elsewhere

Tip: Many companies offer loyalty or retention discounts—so check with your current insurer before switching.

Tips for Lowering Car Insurance Costs

- Bundle Policies: Combine home, life, or car insurance.

- Maintain a Clean Record: No claims = lower premiums next year.

- Opt for Higher Deductibles: Reduces your annual premium, but ensure you can pay it in an accident.

- Check for Online Discounts: Many insurers give cheaper rates for online renewals.

- Review Coverage Annually: Your car’s value and needs change over time.

Final Thoughts

Car insurance doesn’t have to be confusing or expensive. The top 10 plans in 2025 offer options for every type of driver—whether you’re renewing, switching, or just exploring your options.

Always compare price, coverage, benefits, and customer reviews before making a decision. And remember: the cheapest plan isn’t always the best—coverage and claims service matter most.

With the right plan, you can drive with confidence, knowing that your car, finances, and peace of mind are protected.